More hints towards a Rogers sale of the Blue Jays?

Forbes has released their MLB team review! Let us rejoice – maybe just The 10%. The rest of you can go back to drooling over Vlad Jr, we’ll join you in a bit. In the meantime, we’ll be scratching our heads at these figures.

Stoeten touched on this a few years back – 100% of us already miss him – so there really is no need to rehash everything. There are, however, a few Jays-related tidbits needing attention this go-around.

- Operating Profit – Loss of $1.3 million (2017) relative to gain of $23 million (2016).

- Franchise Value – $1.35 billion (2017). $1.3 billion (2016).

- Player Expenses – $180 million (2018). $164 million (2017).

It’s interesting to note the Jays had a swing of $24.3 million in operating income suggesting some fairly legitimate capital investments. A $16 million increase in player payroll will eat up a large portion of that expense, but there is still a question of the remaining $8.3 million. Considering the team cut 23 jobs from their marketing department, it’s logical to assume this increase is not going towards human resources.

Is this Paul Beeston magic? You might remember he’s the one that famously boasted, “I can turn a $4 million profit into a $2 million loss and get every national accounting firm to agree with me.”

This probably accounts for a hefty chunk of that financial swing.

Nothing wrong with this approach, it’s the nature of the beast and this is how teams will continue to operate. The fact that teams are increasingly more vertically integrated is just making it easier. Once again, Stoeten considered this in a piece last October. It should be added that the increase in Jays’ payroll seemingly resulted in an 18% drop in Rogers media division’s operating profit considering this is where the team falls within Rogers’ structure.

Not to scare you, but this really looks like the Jays are being primed for sale.

What’s happening with Rogers and the Jays is eerily similar to what happened with the Florida Panthers back in Wayne Huizenga’s ownership days. We all know Rogers is talking about selling the team so it would make sense for them to insulate their core business at the expense of the Blue Jays. What you may not know is Huizenga owned both the Panthers and its broadcast partner before selling his majority share of the team while keeping ownership of the broadcast partner, including broadcast rights to Panthers games through deals he negotiated with himself.

With the Jays broadcast rights locked up, it can be assumed Rogers has already negotiated a sweetheart deal benefiting the company over the Jays (to some degree). French broadcasts are under contract for another three seasons with TVA Sports – a Rogers subsidiary. The rights to Jays’ games in 2012 were sold to Rogers at $225,000 per game for a 162 game total value of $36 million – not bad right? Well, the Texas Rangers signed a deal the same year for $150 million per year and the San Diego Padres got $75 million per year – now $36 million is a lot tougher to accept as fair considering the Jays’ market size.

Can we please consider the fact that the Padres got double the payout? They play in a saturated market that is still somehow dominated by the Dodgers, while the Jays’ have all of Canada – something is missing here. Or maybe it’s just Rogers squeezing every drop of value from the Jays and leaving the team with pittance.

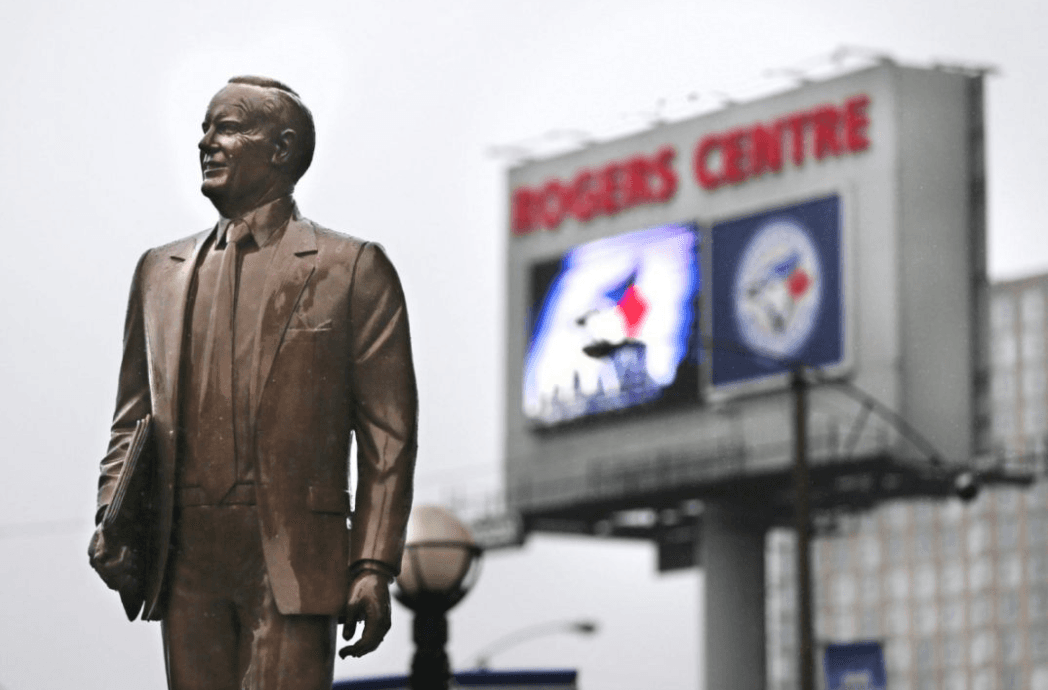

The playbook keeps looking more and more similar to the Panthers’ sale. Rogers has been considering selling the naming rights to Rogers Centre just as the Panthers sold the naming rights to their stadium the season before the team changed owners (2012 for a sale in 2013). Obviously part of the push for Rogers is to recoup some value from their name on the stadium while they are negotiating only with themselves.

Come on!

So we know Rogers has gotten their value out of the Jays and are probably going to sell the team. The next owner has an uphill climb as they can’t rely on revenues from fair broadcast deals. This is why a sale to MLSE makes sense, just as most pundits have mentioned. Rogers could divest their interests in the Jays, while still remaining a minority owner through MLSE. The Jays could slowly bring their financials back to a fair standard assuming MLSE allows it, but this may not even be possible considering the control MLSE has over the Toronto sports market and Rogers has over MLSE – there is no impetus for MLSE to adjust the Jays’ financials in any significant manner.

Before we leave this for you to share your opinions, let’s consider one last point.

The Panthers’ financials were made public through a public offering of shares years ago. Since then, the NHL has removed this option for teams as the public kick back is still being felt. Even though the NHL was claiming Panthers were taking massive losses, financial audits were showing the team actually was profiting every season. Raises questions to how reliable the financial figures were that Forbes reviewed.

If only we could get Paul Beeston to explain this further…

Breaking News

- Instant Reaction: Max Scherzer pitches four hitless innings in Blue Jays 1-0 victory over Phillies

- Instant Reaction: Canada defeats Colombia 8-2 in their World Baseball Classic opener

- What can the Toronto Blue Jays expect from Trey Yesavage in 2026?

- 5 bold predictions for the Blue Jays in 2026

- Team Canada gameday vs. Colombia: Josh Naylor leads the Canucks into first World Baseball Classic matchup