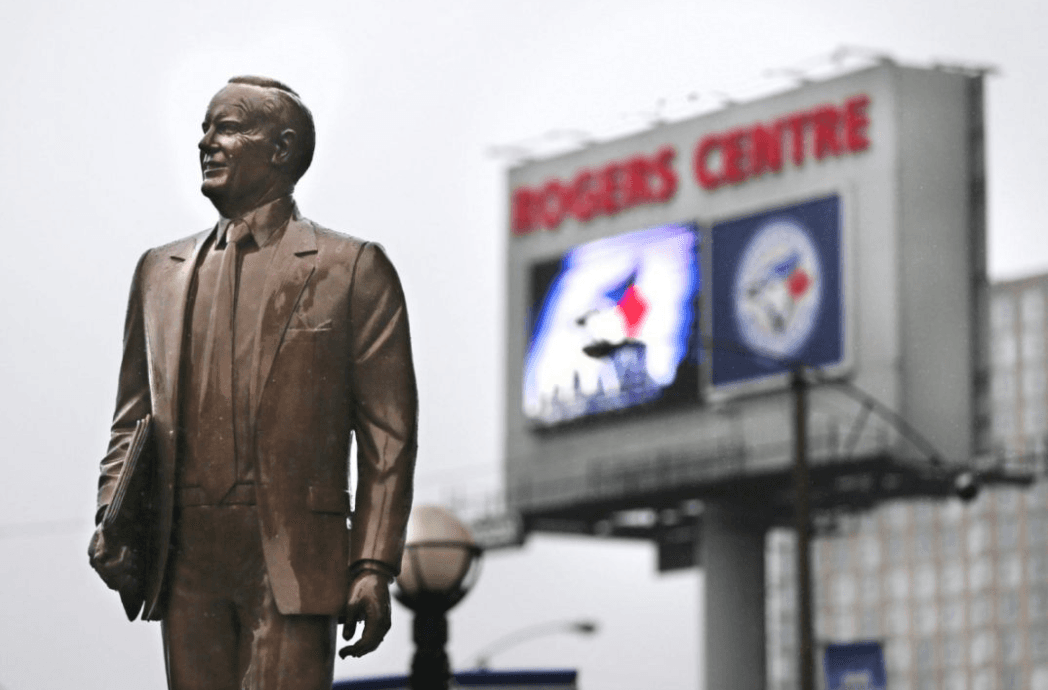

More hints towards a Rogers sale of the Blue Jays?

Breaking News

- Alek Manoah’s return will help the Blue Jays tremendously if he can find his 2022 form

- 2025 MLB Draft – Canadian Watchlist: Blake Gillespie

- Blue Jays prospect Trey Yesavage named to 2025 All-Star Futures Game

- With the eighth overall pick, the Blue Jays could select… Seth Hernandez?

- Blue Jays Minor League Report: Juan Sanchez hit two home runs over the weekend